We are officially two weeks into the New Year. That means two weeks into our New Year’s Resolutions. How are you doing with yours? Is your financial plan going the way you wanted? Are you having some difficulty sticking to the plan? Do you feel as if you are financially stuck?

You are not alone. Changing financial habits is as difficult as changing nutritional ones. We have become accustomed to living our lives on a day-to-day basis, from paycheck to paycheck. Changing that takes time, and dedication.

The cycle of earning, spending, and not enough saving is a common one. We have dreams, but we do not set goals for ourselves to help us achieve them. Instead, we go about our lives thinking it’ll happen one day; when we get that raise, when the kids are older, when we settle down.

Well…your dreams really aren’t that far away. You just have to start by organizing your goals, and making a plan that you can work towards.

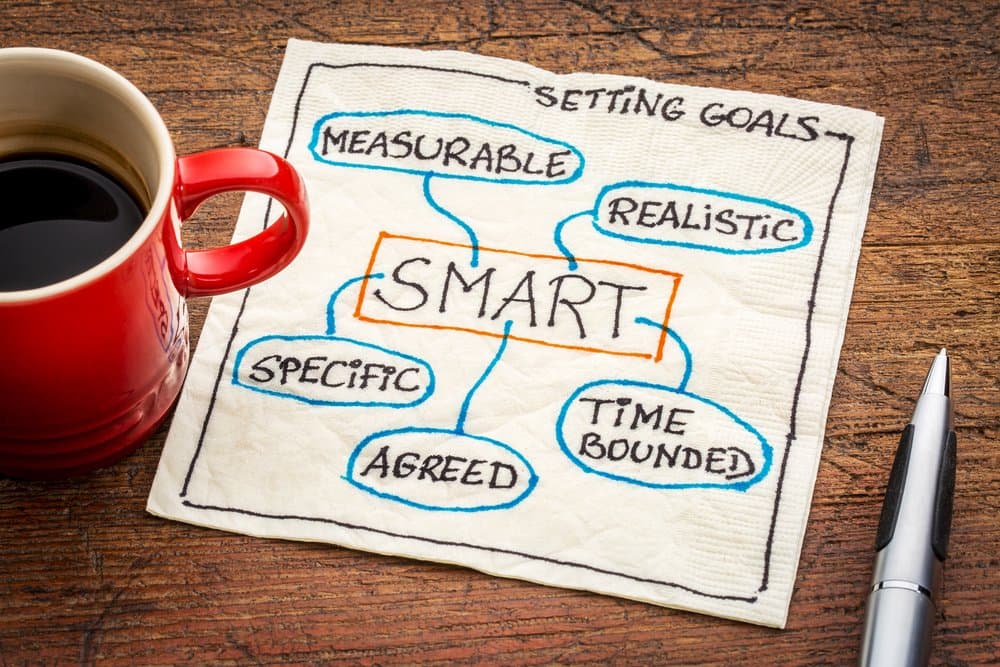

In other words, you have to make SMART goals.

SMART, meaning: Specific, Measurable, Achievable, Realistic, and Time-limited. You have to set a specific area for improvement, it has to have some sort of indication of progress, and someone has to be specified to the task. You have to think about what realistically can be achieved, based on your resources, and you need to specify a time by which you will have achieved the goal.

I’m not just making this up off the top of my head. The concept of SMART goals was started by George Doran in 1981 when he published a paper, “There’s a S.M.A.R.T. Way to Write Management’s Goals and Objectives.” He explained how to apply the SMART acronym into setting and achieving your goals. When setting goals, we don’t have to include all the elements of the SMART acronym in order to have success. Not every goal will fit all the criteria, but it’s a good base to have when generating and planning your next steps.

You can start making goals now. Look at what your ultimate goal is and then break that down into smaller and smaller goals. If you’re completing a different goal every week, or even everyday, you’re going to get to your ultimate goal a lot easier and faster. In my opinion, it’s nice to set small goals because you get a little confidence boost after completing each micro-goal. You can track your progress daily, which leaves you with an enjoyable feeling of fulfillment.

SMART goals will lead you, step-by-step, to accomplishing what you ultimately desire. The purpose of them is to make you plan out the path you’ll take to fulfill your goals. If you struggle with completing your goals, try exercising the SMART format into your plans. It just might get you somewhere.