TL; DR

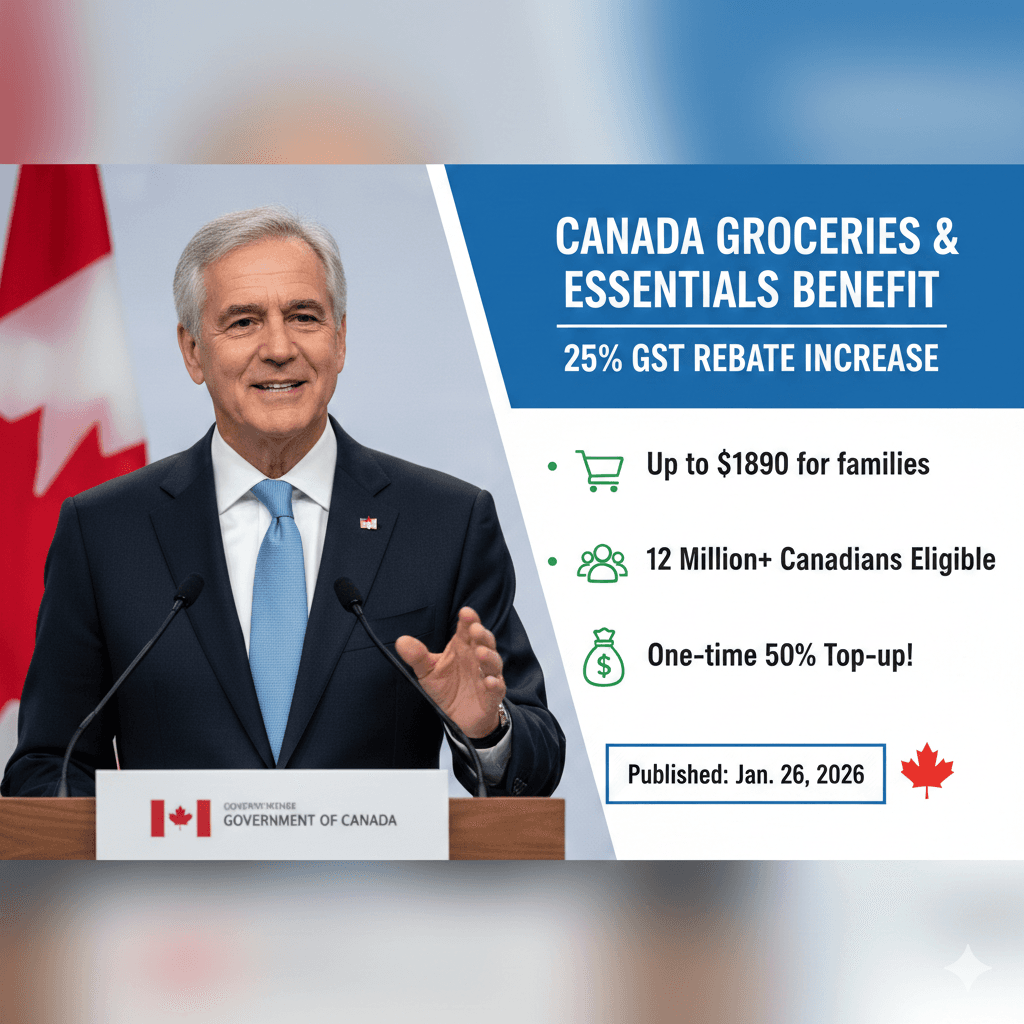

Prime Minister Mark Carney has announced a 25% boost to the GST credit, now called the Canada Groceries and Essentials Benefit. Eligible families of four will receive up to $1,890 this year instead of $1,100. More than 12 million Canadians qualify, and the Conservatives have confirmed they'll let it pass Parliament.

What’s Changing?

GST credit increases by 25%: Starting July 2026, quarterly GST payments rise by 25% for the next five years

One-time 50% top-up this year: Eligible Canadians will receive an additional boost equivalent to 50% of their regular credit in 2026

12 million Canadians affected: Anyone currently receiving the GST credit automatically qualifies for the enhanced benefit

How Much Extra Money Will You Actually Get?

The short answer: a family of four could receive up to $790 more this calendar year. A single person could see an extra $410. Here's what that means for you in plain English.

The Dollar Breakdown

The Canada Groceries and Essentials Benefit replaces the existing GST credit with the same eligibility rules but higher payments. The GST credit is a quarterly payment that returns a portion of the federal sales tax to Canadians with lower incomes.

Household Type | Current Annual Amount | 2026 Amount (with top-up) | 2027-2030 Annual Amount |

Single person | $540 | Up to $950 | About $700 |

Family of four | $1,100 | Up to $1,890 | About $1,400 |

The one-time 50% top-up arrives this June (2026). After that, the ongoing 25% increase continues through quarterly payments until 2031.

Do I Qualify?

Good news: if you're already getting the GST credit, you automatically qualify. That typically means you're a Canadian resident for tax purposes and at least 19 years old, with an adjusted net income below certain limits. For 2024, single people without kids qualified with incomes of $56,181 or less.

The government is also introducing Automatic Federal Benefits starting in the 2026 tax year. This change will ensure up to 5.5 million low-income Canadians receive benefits automatically. No separate application will be required by the 2028 tax year.

Why It Matters

Let's talk about what's keeping Canadians up at night: grocery prices. Food costs have climbed significantly over the past five years. According to the 2026 Food Price Report from Dalhousie University, we're looking at another 4% to 6% increase this year.

The Immediate Impact

If you're already watching every dollar at checkout, timing is everything. Grocery inflation hit 4.7% in November 2025. That’s the highest it’s been since 2023. Beef prices are up 17.7% year-over-year. While this rebate won't bring down sticker prices at the store, it does put real money back in your pocket when those quarterly payments land.

When you're spending 30% of your income on essentials instead of 15%, every price spike hits much harder. That's why this benefit focuses on low-to-modest income households.

The Bigger Picture

Beyond direct cash relief, Prime Minister Carney announced a broader food affordability package worth roughly $670 million. This includes $500 million from the Strategic Response Fund to help food suppliers grow their operations, $150 million for a new Food Security Fund supporting greenhouses and meat processors, and $20 million for the Local Food Infrastructure Fund helping food banks.

The government is also working on a National Food Security Strategy with unit-price labelling. Stores would have to show prices per standard measure, making it way easier to catch shrinkflation and compare real value between products.

Our Take

This rebate offers real help to eligible households. But let's be honest: it's still not treating the full issue. It helps people manage high prices, but it’s doing so without bringing those prices down.

That said, the program targets the right people. Lower-income Canadians spend more of their budget on food, so directing cash here creates the biggest impact. And using the existing GST credit system means money flows fast without bureaucratic delays.

The five-year timeline is worth noting. Food prices have been elevated since pandemic supply shocks, and nobody knows exactly when things will normalize. A temporary program addresses what might be temporary pressures without locking in permanent spending.

Some context on the cost: the federal government estimates $3.1 billion in year one, reaching $11 to $12 billion over five years.

What Industry and Politicians Are Saying

The Political Response

"Canada's new government is acting today to provide a boost to Canadian families who most need one. We're creating a bridge to longer-term food security and affordability." — Mark Carney, Prime Minister of Canada

Conservative Leader Pierre Poilievre confirmed during Monday's Question Period that his party will let the GST top-up pass Parliament. Earlier this weekend, Poilievre had sent an open letter offering to fast-track policies on affordable groceries, among other issues.

"Mr. Poilievre stated that he would fast-track ideas that make food affordable. He has that chance with these brand-new affordability measures." — Steven MacKinnon, Government House Leader

Expert Perspective

Dr. Sylvain Charlebois leads Dalhousie University's Agri-Food Analytics Lab and authored Canada's Food Price Report. He has noted that food affordability will remain a pressure point throughout 2026. The structural issues driving Canadian grocery prices predate the current inflation spike. They include market concentration, where the top four grocery chains control at least 72% of the national market share.

What to Watch

Key Dates

July 2026: First enhanced quarterly payment arrives for eligible Canadians

June 2026: One-time 50% top-up payment distributed

January 2026: Canada's Grocery Code of Conduct becomes fully operational

Signals to Monitor

Quarterly CPI food inflation data: Statistics Canada releases monthly, but quarterly trends will show whether grocery inflation is moderating or accelerating

Competition Bureau activity: The government pledged to support enforcement in the grocery sector; watch for investigations or actions against major chains

Food Price Report updates: Dalhousie University's team tracks prices in real-time and issues mid-year corrections when forecasts shift

📊 Key Number

$17,571.79

The projected annual food cost for a Canadian family of four in 2026. That's up nearly $1,000 from last year, according to the Dalhousie Food Price Report.

FAQs

Do I need to apply for the Canada Groceries and Essentials Benefit?

No application required. If you're already getting the GST credit, you're all set. The enhanced payments will come automatically. You'll see the one-time top-up in June 2026, then regular quarterly payments after that.

When will I see the extra money?

The one-time 50% boost hits your account in June 2026. After that, you'll get an ongoing 25% increase starting with your July 2026 quarterly payment, and that continues all the way through 2031.

Does this benefit apply to newcomers?

Yes. If you're a newcomer who qualifies for the GST credit, you'll get the enhanced benefit too. According to CIC News, eligible newcomers could receive up to $417 extra this year, plus up to $167 per year for the next five years.