Menu

Table of contents :

When it comes to borrowing money, sometimes it makes sense when the cost of the loan is less than the cost of NOT borrowing. Let me explain: Maybe your car breaks down on a Tuesday, but you don’t get paid until next Friday. Your dog decides he’s going to eat the random piece of food he found outside on your walk, and suddenly, you’re spending your day at the vet, wondering how much your bill is going to be.

The point is, life doesn't always wait for payday.

The good news? Borrowing money in Canada has never been more accessible and easier than it is now. Whether you're dealing with an emergency or just need a bit of extra cash to cover groceries and bills, understanding your options helps you make smart decisions that protect your financial health.

When it comes to borrowing money online in Canada, knowledge is power. Arming yourself with information about how these modern solutions compare to traditional methods, as well as understanding eligibility requirements and how to borrow responsibly without getting trapped in a cycle of debt, is extremely important. We’re going to do our best to help you with that today.

Borrow Money

Multiple borrowing options exist in Canada, from traditional bank loans to modern online solutions

Online options offer speed and convenience with applications taking minutes, not days

Bad credit doesn't eliminate all options - many lenders consider income and employment over credit scores alone

Understanding terms prevents costly mistakes - know exactly what you're paying before you commit

Being responsible protects your financial health - only borrow what you can realistically repay

iCash offers transparent instant loans with same-day funding, licensed operations, and 24/7 approvals when you need cash fast

Before you think about borrowing money, the first important step is to decide if you even really need it to begin with. Here’s a small example of real-life scenarios where you might consider applying for a quick loan.

The Car Repair Emergency: Your transmission fails on Monday morning. You need your car to get to work, but the repair costs $800, and payday isn't until next Friday. A short-term car repair loan covers the fixes, keeps you employed, and costs less than missing work.

The Medical Gap: Your dental crown breaks, causing pain. Your insurance covers most of it, but you need $500 upfront for the deductible. Waiting two weeks isn't realistic when you're in pain.

Avoiding Bigger Fees: Your rent is due tomorrow, but your paycheck hits your account in two days. Your landlord might charge a late fee. Even with an interest fee, it’s likely better than paying the late fee from your landlord.

The Timing Mismatch: You started a new job with a good salary, but your first paycheck is two weeks away. Your bills don't wait. A small loan helps you bridge the gap between jobs without derailing your finances.

Option | Best For | Speed | Approval requirements | Key Considerations |

Payday Loans | Emergency cash needs, bad credit situations | Near instant. Funds can be received in 2 minutes (after approval) | Proof of income, active bank account, 18+, etc. | Higher interest rates but fast access; ideal for short-term needs under $1,500 |

Borrowing Apps | Small amounts ($50-$500) | Minutes | Bank account, steady income, etc. | Mobile-first experience, smaller loan amounts, growing in Canada |

Credit Cards | Planned purchases, building credit | Instant (if approved) | Good credit score | Cash advances are expensive; best if you can pay off monthly |

Line of Credit | Ongoing access to funds, larger amounts | Days, to (possibly) weeks | Good credit, income verification | Lower rates than credit cards, flexible borrowing up to the limit |

Friends/Family | Interest-free, flexible terms | Immediate | Personal relationship | Can strain relationships; always formalize agreements in writing |

Traditional Bank Loans | Large amounts, best rates for qualified borrowers | 1-2 weeks | Strong credit, extensive documentation | Competitive rates but a lengthy approval process, less flexible |

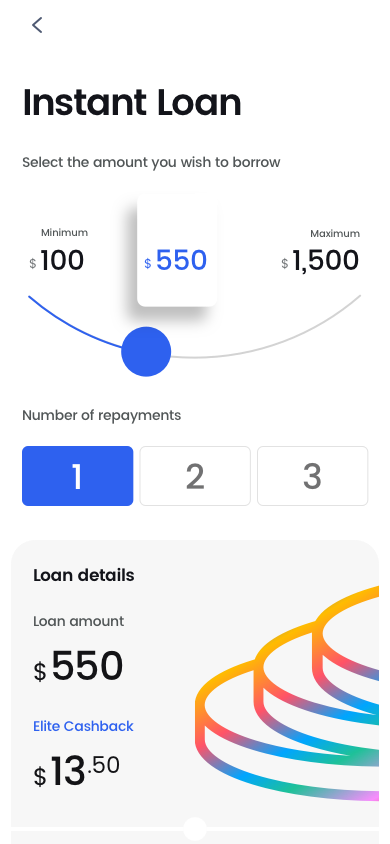

Getting an online loan with us is fast and easy. Simply select your loan amount, repayment plan* and provide some personal details.

Our online loan application will tell you if you’re approved instantly. Once approved, all you have to do is electronically sign your contract. It’s that easy!

Once you sign your digital agreement, your cash advance will be sent by e-Transfer within 2 minutes. Fast, convenient and hassle-free. Funds are sent 24/7, no matter what.

Getting approved with us is pretty easy. You just need to meet these minimum requirements:

Be at least 18 years old (19 years old for applicants in British Columbia, New Brunswick, Nova Scotia)

Be a resident of any of the provinces in which we operate (AB, ON, BC, MB, NB, NS, PEI).

Show that you have been receiving the same source of income for the past three months.

Have a total net income of at least $800/month.

Have access to an online bank account, in which pre-authorized debits can be performed.*

Have a valid Canadian mobile phone number, address, and email address (VoIP numbers are not accepted)

*Please note that KOHO accounts do not qualify as they do not support pre-authorized debits.

Good news if your credit's in a rough spot: Lots of online lenders care way more about your current income and job than past credit mess-ups. With us, as long as you're making money (multiple sources accepted, including government benefits) and can pay it back, there’s a good chance you’ll still qualify even with bad credit.

Borrowing's easy. Paying it back smart is what keeps your finances safe. Here are a few tips to help you stay on track whenever you borrow money online.

Set yourself up to win:

1. Calendar Everything

Stick your payment date in your phone with a reminder 2 days before. Treat this like rent - you can’t miss the payment.

2. This Payment Comes First

Before you spend on takeout, going out, or shopping, make sure your loan payment's covered. Miss a payment and you could potentially get hit with late fees and collections calls.

3. Contact Your Lender If You're Struggling

If you realize you can't make the payment, call your lender right away. Never ghost a loan you can't pay. Lenders can work with you if you talk to them. On our end, that’s precisely what we’ll do, but you have to make sure you contact us right away.

4. Pay Early If You Can

Most online lenders let you pay early without penalties. Got paid before your due date or came into unexpected money? Use it to pay off your loan and you’ll have one less thing to think about.

When surprise expenses hit, you need a lender you can trust. We offer:

✅ Fast approvals - instant decisions, 24/7, even on weekends and holidays

✅ Same-day funding - money in your account in 2 minutes via e-Transfer

✅ Clear terms - no hidden fees, ever

✅ Licensed operations - fully regulated in AB, BC, MB, NB, NS, ON, PEI

✅ 93% approval rate - we look at more than just credit scores

✅ Flexible payback - up to 62 days (dependent on provincial regulations. Conditions apply)

Since 2016, we've helped over 1.6 millions Canadians get instant loans online.

Since 2016, we've helped over 1.6 millions Canadians get instant loans online.

Read more reviews.

Have more questions? Check out our full FAQ.